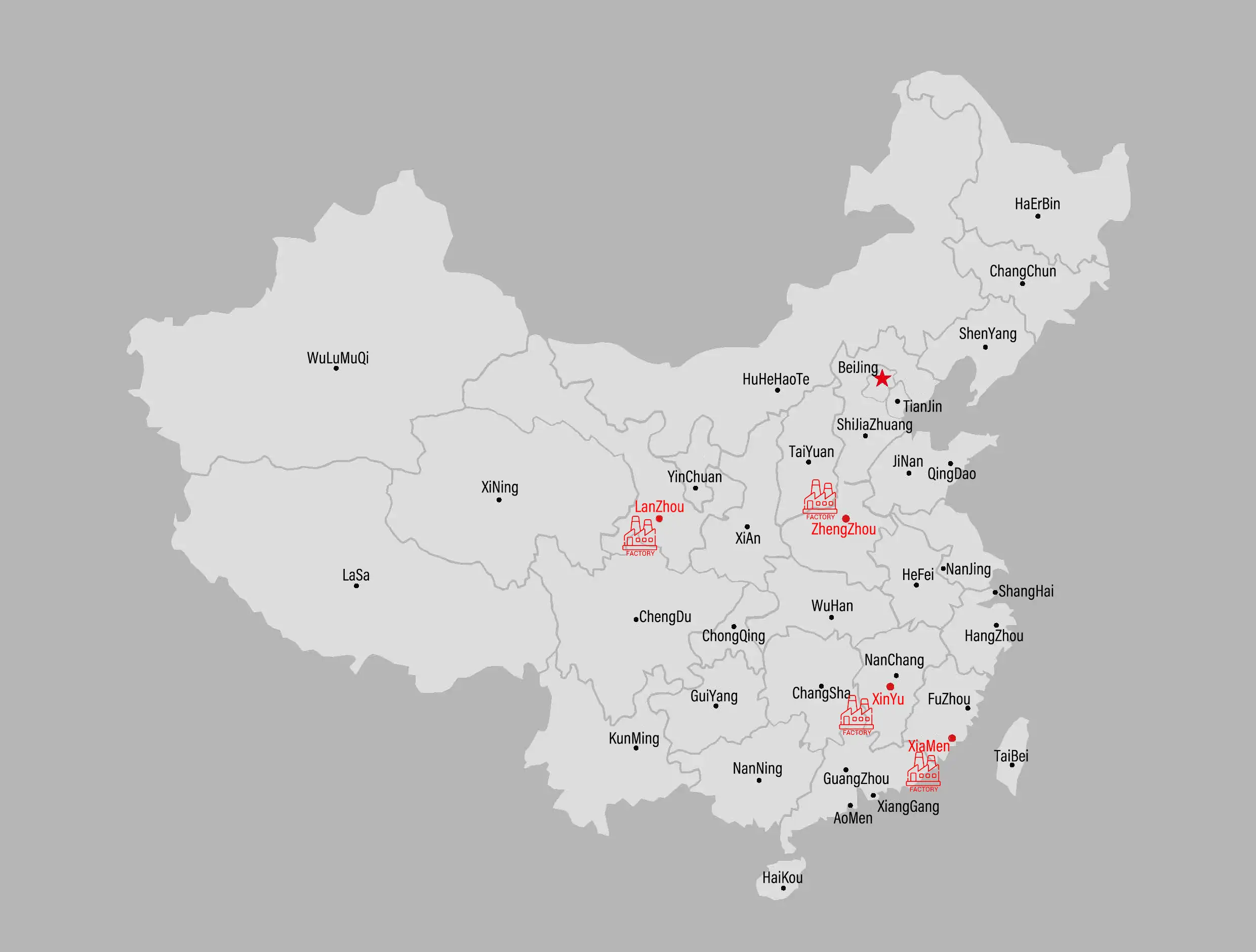

Zhengzhou ChangHeYue New Material CO.,LTd

Global Petroleum Coke Market Monthly Report: April 2025 Review & May Outlook

Global Petroleum Coke Market Monthly Report: April 2025 Review & May Outlook

Market Overview

In April 2025, China’s petroleum coke market exhibited mixed trends across state-owned refineries:

- CNPC (China National Petroleum Corporation): Prices increased by $27.59/MT (200 RMB/ton) in Northeast China, while remaining stable in Northwest China.

- Sinopec: Operations focused on fulfilling contract orders, with prices fluctuating narrowly.

- CNOOC (China National Offshore Oil Corporation): Conducted competitive bidding for low-sulfur coke, with prices showing regional variations.

By April 29, average prices stood at $580/MT for low-sulfur coke (month-on-month decrease: 13.92%) and $458/MT for mid-to-high sulfur coke (month-on-month decrease: 15.17%).

Independent Refineries: Supply-Demand Dynamics

Independent refineries saw a “rise-then-fall” trend, closing April with an average price of $335/MT (month-on-month increase: 0.71%). Key drivers included:

- Supply Constraints: Average coker utilization rate dropped to 62.28% (down 0.89% MoM), driven by maintenance at key refineries (e.g., Huifeng Petrochemical, Dongming Petrochemical) and partial restarts.

- Demand Shifts: Early-month price support from mid-to-high sulfur demand faded in late April amid easing cost pressures and stagnant downstream consumption.

- May Outlook: Further utilization rate declines are expected as additional maintenance plans take effect.

Downstream Sector Highlights

Calcined coke prices stabilized regionally:

- Northeast China: Low-sulfur calcined coke held steady at $758/MT.

- Shandong Province: Mid-to-high sulfur calcined coke traded between $321–469/MT.

While cost relief for low-sulfur coke supported steady procurement, demand from负极材料 (anode materials) and graphite electrodes remained subdued.

May 2025 Market Forecast

The petroleum coke market is projected to follow a “down-then-up” trajectory in May, influenced by:

- Tightening Supply: Expanded refinery maintenance schedules and potential import reductions.

- Demand Resilience: Stable demand from carbon product industries, offsetting slower consumption in新能源 (new energy) sectors.

- Cost Volatility: Upstream price fluctuations may drive short-term adjustments.

Strategic Recommendations

- For Buyers: Monitor refinery maintenance timelines and port inventory trends. Consider building strategic reserves during price dips.

- For Sellers: Optimize pricing strategies to align with regional demand variations, particularly in Southeast Asia and emerging markets.

As your trusted partner in energy markets, we provide real-time insights and tailored procurement strategies to navigate global petroleum coke dynamics. For detailed analytics or customized reports, contact our team at sales@chycarbon.com.